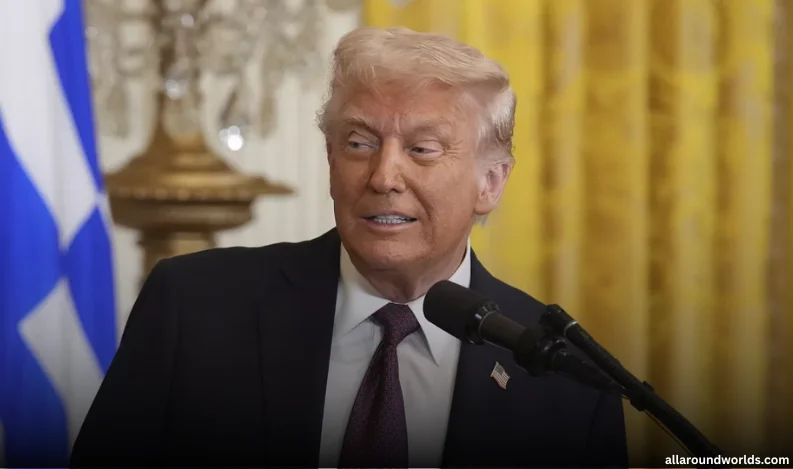

Trump’s Tariff Retreat Reveals Wall Street’s Lingering Influence Over White House Policy

In a week that rattled global markets and tested investors’ confidence, President Donald Trump’s unexpected rollback on sweeping tariffs proved one thing: Wall Street still holds sway in Washington.

After nearly a week of sharp declines in equities and an uncharacteristic sell-off in U.S. Treasurys, market participants had begun to fear that a longstanding assumption about Trump’s presidency — that he listens to markets — no longer held true. But just past 1:00 p.m. ET on Wednesday, Trump reversed course, announcing a pause on the most aggressive of his tariffs, a move that sent the S&P 500 into its strongest single-day rally since the 2008 financial crisis.

The decision followed mounting pressure from prominent Wall Street figures and market volatility that signaled not just investor anxiety, but systemic risk. The president, often defiant in the face of criticism, acknowledged watching the bond market closely and described the recent reaction as “getting yippy.” His reference, while colloquial, underlined a deeper shift: economic pain was being felt not just in political talking points but in the foundational mechanisms of the global financial system.

From Shock to Relief

The dramatic turnaround comes after a turbulent week in which Trump’s tariff strategy — including new levies reaching 125% on Chinese goods — prompted a massive sell-off in stocks and sparked a rare exodus from U.S. Treasurys, typically seen as a safe haven during uncertainty.

“It goes without saying that last week’s price action was shocking,” said R. Scott Siefers, analyst at Piper Sandler. “The market has begun to rewrite its understanding of what a second Trump term means for the economy.”

The market’s reaction sent a strong message: economic nationalism, when taken to extremes, risks undermining investor confidence, destabilizing bond markets, and potentially triggering a recession.

One of the pivotal voices in shifting sentiment may have been Jamie Dimon, CEO of JPMorgan Chase. In a scheduled Fox News interview earlier Wednesday, Dimon warned that the administration’s tariff policies were “pushing the economy toward the edge.” Trump later cited the commentary, along with broader market signals, as reasons for his recalibration.

Bond Market Alarm Bells

The response from the bond market, in particular, appeared to weigh heavily on the White House. The sharp rise in Treasury yields suggested not just uncertainty, but potential liquidation by sovereign or institutional investors — a development that could raise borrowing costs for the federal government, businesses, and everyday consumers.

Mike Mayo, a banking analyst at Wells Fargo, described the financial markets as a “governor” on policy. “You push so hard, but you don’t want it to break,” he said, referencing reports of stressed trades and extreme volatility in debt markets.

Veteran market analyst Ed Yardeni pointed to the role of so-called “bond vigilantes” — investors who sell off government bonds in protest of fiscal irresponsibility — as key to Trump’s U-turn. “The bond market was anticipating a real crisis,” Yardeni told CNBC.

Wall Street’s Role: Diminished or Reaffirmed?

Throughout the early days of Trump’s second presidency, some investors worried that the Wall Street voices who once had direct lines to the Oval Office — such as former Goldman Sachs executives Gary Cohn and Steven Mnuchin — were now absent. But the events of this week suggest that financial elites still function as guardrails, even amid an administration known for testing institutional boundaries.

Yet the episode also illustrated the fragility of that influence. The rally following the tariff rollback was short-lived. By Thursday morning, markets had resumed their decline as investors digested the fact that a 10% universal tariff on all imports remains in place, and that relations with China — now facing a tariff hike from 104% to 125% — are deteriorating further.

Bank Stocks, Deals, and the 'Chaos Discount'

Few sectors have felt the pressure more acutely than banking. Once expected to benefit from Trump’s pro-business stance through deregulation and renewed M&A activity, banks instead saw their post-election gains wiped out last week. As uncertainty grew, dealmaking slowed and stock prices for major banks entered bear market territory.

“We call it the chaos discount,” said Brian Foran, an analyst at Truist. He noted that forecasting winners and losers amid an unpredictable trade war had become almost impossible.

As earnings season kicks off Friday with JPMorgan reporting first-quarter results, analysts will be watching closely for signs of how consumer sentiment, credit conditions, and corporate activity have fared in the face of policy whiplash.

A Narrow Escape—and a Lingering Threat

For now, Trump's partial retreat has temporarily steadied financial markets. But experts caution that such episodes, if repeated, could erode investor confidence long-term and force more reactive policymaking.

“We got close, and that’s a very uncomfortable place to be,” said Mohamed El-Erian, chief economic advisor at Allianz, in an interview on CNBC. “The more you get to that point repeatedly, the higher the risk that you’re going to cross it.”

With uncertainty still surrounding the future of U.S.–China trade relations and the full impact of the 10% universal tariffs yet to be realized, Wall Street’s influence may prove both indispensable — and insufficient — in guiding the direction of global economic policy.

Recent Comments: