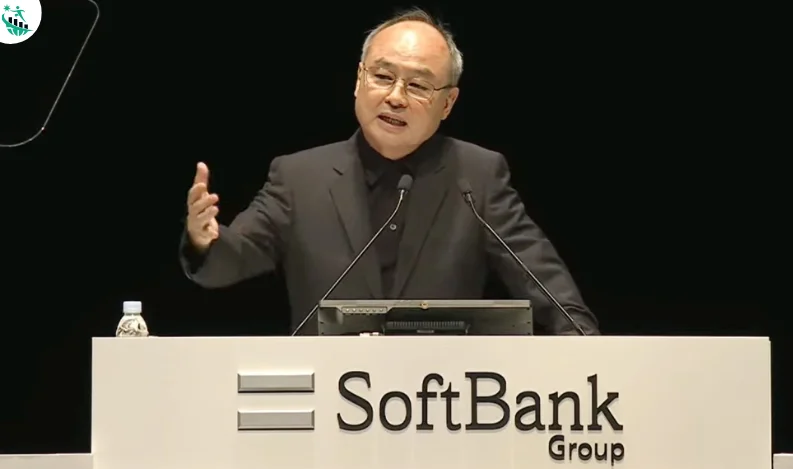

SoftBank Loses $32 Billion in Market Value as Asian AI Stocks Slide

Tokyo — Shares of SoftBank Group plunged more than 14% on Wednesday, wiping out about $32 billion in market value, as investors across Asia pulled back from AI-linked stocks amid mounting concerns over stretched valuations.

The sell-off followed a sharp global retreat in technology shares, echoing losses among U.S. peers. SoftBank’s drop marks its worst trading day since August 2024, when the stock tumbled more than 18%, according to LSEG data. The company has now lost nearly $50 billion in market capitalization over two sessions, after a 7% fall on Tuesday.

SoftBank, known for its aggressive bets on artificial intelligence, holds a controlling stake in U.K.-based Arm Holdings, whose chip designs power most modern smartphones and AI processors. Arm’s shares on Nasdaq slid 4.7% overnight, while SoftBank’s recent purchase of Ampere Computing has also drawn investor scrutiny as markets reassess valuations in the sector.

Other Japanese technology stocks mirrored the slump. Advantest fell over 8%, Renesas Electronics lost 5.5%, and Tokyo Electron declined more than 5%. Across the region, Samsung Electronics and SK Hynix in South Korea each dropped nearly 6%, while Taiwan’s TSMC slipped 2%. Chinese tech majors Alibaba and Tencent also traded lower.

The downturn followed comments from several Federal Reserve officials, who cautioned against further rate cuts this year. Their remarks, coupled with a stronger U.S. dollar and valuation worries, pressured risk assets across global markets.

U.S. software company Palantir fell about 8% overnight despite beating earnings expectations, while Nvidia, AMD, Oracle, and Amazon also recorded declines. Analysts said the broader pullback reflects investor unease over whether the AI boom has run ahead of fundamentals.

Market veteran Louis Navellier warned that an “AI correction” could ripple through global equities given the sector’s outsized weight. Others, including economist Jared Bernstein, compared current AI investment levels to the late-1990s dot-com era, noting that capital flows now exceed those seen during the internet bubble.

Adding to sentiment, “Big Short” investor Michael Burry recently disclosed short positions against Palantir and Nvidia, amplifying fears of overvaluation.

Still, some analysts see the sell-off as a temporary pause. “In my view, this is short-lived,” said Dan Ives of Wedbush Securities. “I don’t think it’s the start of a deeper downturn, just nervous trading after months of heavy gains.”

Recent Comments:

No comments yet.