Senator Warren Accuses CFPB Director of Undermining Trump’s Credit Card Affordability Push

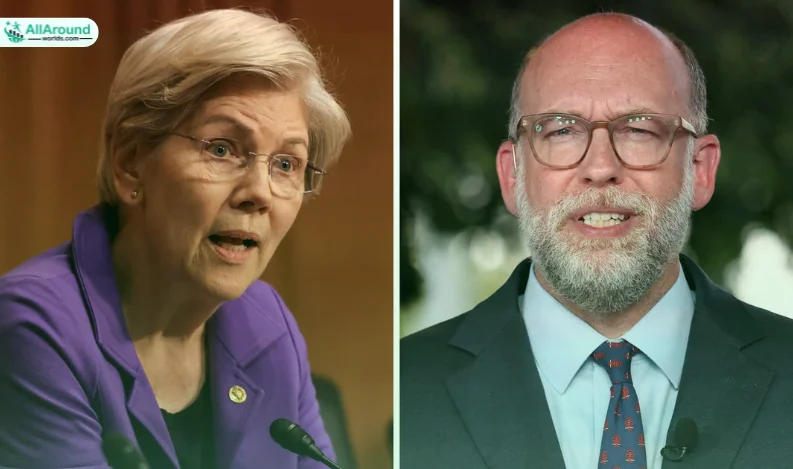

Washington - US Senator Elizabeth Warren has accused the acting head of the Consumer Financial Protection Bureau of undermining President Donald Trump’s push to make credit cards more affordable, escalating tensions within the administration over financial regulation.

In a letter sent Friday to Russell Vought, Warren said the CFPB’s recent actions run counter to Trump’s stated goal of lowering borrowing costs for American consumers.

Trump earlier this month called on US banks to voluntarily cap credit card interest rates at 10% for one year. After banks declined to do so, the president urged lawmakers this week to pursue legislation to enforce the cap.

Warren Cites CFPB Rollbacks

In her letter, Warren pointed to several regulatory changes made at the CFPB over the past year, including the rollback of a rule limiting credit card late fees, the agency’s support of lenders in lawsuits involving deceptive practices, and the suspension of enforcement actions against parts of the credit card industry.

“While Congress considers legislation to address the issue, your own actions are directly undermining the President’s stated goals,” Warren wrote.

“Under your leadership, the CFPB has taken steps to make it easier, not harder, for big banks and credit card companies to rip off Americans.”

Warren said she had spoken directly with Trump about the issue and told him that Congress could pass legislation to cap credit card interest rates if he supported the effort.

Pressure on a Weakened Agency

The dispute highlights growing divisions over the future of the Consumer Financial Protection Bureau, which Warren helped establish following the 2008 financial crisis.

Members of the Trump administration have pushed to significantly scale back or eliminate the agency as part of a broader deregulatory agenda aimed at easing burdens on businesses and financial institutions.

Current and former CFPB staff have said the agency has been severely weakened under Vought’s leadership, citing legal efforts to impose mass layoffs and halt the bureau’s funding.

A CFPB spokesperson said the agency is prohibited from limiting credit card interest rates under the Dodd-Frank Act, which governs its authority.

Calls for Immediate Action

Warren urged Vought to reverse several recent decisions, including reinstating a rule that would cap credit card late fees at $8, a measure she said could save consumers more than $10 billion annually.

She also called on the CFPB to crack down on deferred interest promotions, resume oversight of interest rate increases, respond more aggressively to consumer complaints, and stop what she described as bait-and-switch practices in rewards programs.

“Either President Trump is not serious about making credit cards more affordable or you are insubordinately disregarding his direction,” Warren wrote.

The clash underscores the political and regulatory uncertainty surrounding credit card regulation, as lawmakers debate whether legislative action is needed to rein in borrowing costs for US consumers.

Recent Comments:

No comments yet.