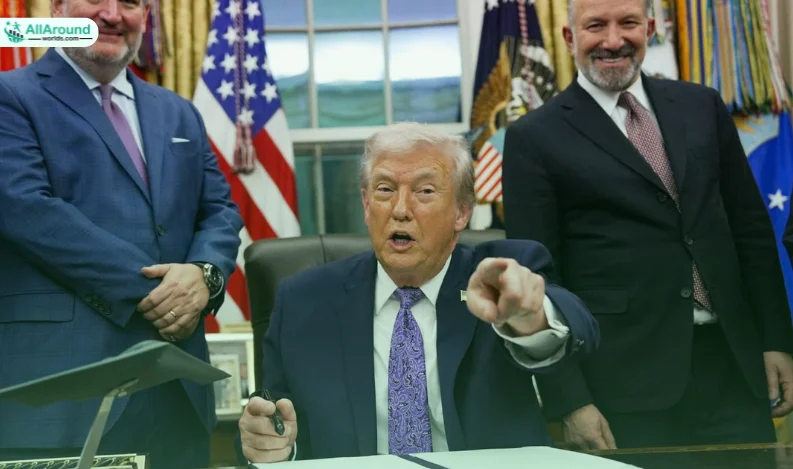

US, Taiwan sign $250 billion trade deal, slash tariffs to 15%

The United States and Taiwan have signed a sweeping trade agreement that cuts tariffs on Taiwanese goods to 15% in exchange for $250 billion in new Taiwanese investments across the U.S. technology sector, marking one of the most significant bilateral economic deals under President Donald Trump’s trade strategy.

The agreement, announced Thursday, is part of a broader tariff overhaul launched by the Trump administration last April aimed at reducing trade imbalances and accelerating domestic manufacturing. Similar arrangements have already been concluded with the European Union and Japan, while a separate one-year truce remains in place with China.

Under the new deal, tariffs on Taiwanese exports will fall from an earlier peak of 32% to 15%, bringing Taiwan in line with other major U.S. trading partners in the Asia-Pacific region, including Japan and South Korea.

The U.S. Department of Commerce described the agreement as a “historic trade deal” that will help drive large-scale reshoring of advanced manufacturing, particularly in semiconductors. The department said the partnership will lead to the creation of multiple U.S.-based industrial parks designed to strengthen domestic production capacity.

Taiwan’s government confirmed the core terms, saying the agreement exports the “Taiwan model” of advanced manufacturing to the United States while deepening strategic economic cooperation between the two sides. Officials said Taiwanese companies would invest heavily in semiconductors, artificial intelligence applications and energy-related industries.

In addition to lower tariffs, the deal includes exemptions for selected imports from Taiwan, including generic pharmaceuticals and aircraft components. Taiwanese semiconductor manufacturers that expand operations in the United States will also qualify for preferential tariff treatment, including exemptions, according to the Commerce Department.

The announcement drew sharp criticism from Beijing, which claims Taiwan as part of China. A Chinese government spokesperson described the deal as “economic plunder,” accusing Washington of exploiting Taiwan for strategic gain.

The agreement comes amid strong momentum in Taiwan’s semiconductor sector, led by Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest contract chipmaker. On the same day the deal was announced, TSMC reported a 35% year-on-year jump in net profit for the October–December quarter, driven by surging demand linked to artificial intelligence.

TSMC posted net profit of 506 billion New Taiwan dollars ($16 billion), exceeding market expectations. Quarterly revenue rose 21% to more than 1.046 trillion New Taiwan dollars ($33 billion), underscoring the company’s dominant position in advanced chip manufacturing.

The company said it plans to raise capital expenditure to between $52 billion and $56 billion in 2026, up from about $40 billion last year. Its Taiwan-listed shares have climbed nearly 60% over the past 12 months.

Speaking on an earnings call, TSMC Chief Financial Officer Wendell Huang said demand for the company’s most advanced process technologies remains strong and is expected to support elevated spending levels over the next several years. Chairman and Chief Executive C. C. Wei acknowledged investor concerns about a potential AI bubble but said customer demand remains genuine and growing.

TSMC, a key supplier to firms including Nvidia and Apple, currently holds a market capitalisation of about $1.4 trillion, making it Asia’s most valuable listed company. Analysts say its central role in AI chip production gives it strong pricing power and insulation from short-term market volatility.

The company has already pledged roughly $165 billion in U.S. investments and is accelerating construction of new fabrication plants in Arizona as it seeks to meet rising demand from global clients.

Recent Comments:

No comments yet.