Trump’s Clash With the Fed Rattles Markets. What UAE Investors Should Watch Next

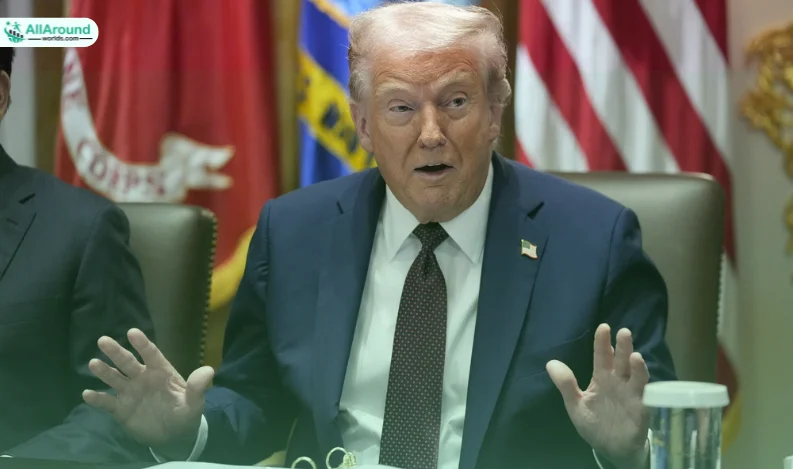

Global financial markets are being forced to reprice political risk after a fresh confrontation between US President Donald Trump and the Federal Reserve, reviving concerns over the independence of the world’s most influential central bank.

The trigger was a move by the US Justice Department to issue subpoenas related to the Federal Reserve, unsettling currencies, bonds and equities at a time when investors had been expecting a period of relative monetary stability.

Market strategists warn that any perception of political interference in US monetary policy could have far-reaching implications, not just for Wall Street, but also for dollar-linked economies such as the UAE.

Dollar stability under scrutiny

The immediate market concern is the US dollar’s credibility. The greenback’s status as a global reserve and safe-haven currency rests heavily on confidence in the independence of US institutions, particularly the Fed.

Michael Brown, senior research strategist at Pepperstone, described the subpoenas as “another blatant attempt to erode policy independence,” arguing that the issue goes far beyond procedural or administrative matters.

“This isn’t a construction case,” Brown said. “It strikes at the very heart of Fed policy independence.”

While Brown expects the Federal Reserve to comply with the legal process, he warned that prolonged political pressure could force markets to price in a higher risk premium on US assets.

“Both the USD and US Treasuries will now have to price a considerably higher risk premium,” he said, adding that any escalation into criminal charges would likely trigger sharper selling pressure.

For UAE investors, a weaker or more volatile dollar matters directly. The dirham’s peg to the US currency means sustained dollar instability could influence imported inflation, overseas investment returns and capital flows.

Bonds, yields and gold in focus

A politicised Fed could also push long-term US bond yields higher as investors demand greater compensation for risk. Rising yields tend to pressure equities globally, particularly growth stocks and emerging-market assets.

At the same time, analysts say gold could benefit if confidence in US institutions erodes further. As a traditional hedge against political and monetary uncertainty, bullion often attracts inflows during periods of dollar weakness, a trend closely watched by regional investors with exposure to commodities.

Equities may stay resilient, for now

Despite the uncertainty, strategists say equity markets may not react uniformly. As long as corporate earnings and economic growth remain intact, some investors may continue buying on dips.

However, any prolonged standoff between the White House and the Fed could change that calculus, especially if it begins to influence interest-rate expectations or inflation forecasts.

What UAE investors should monitor

For investors in the UAE, analysts recommend watching three key indicators in the coming weeks:

– Signals from the Federal Reserve on its policy stance and institutional independence

– US dollar movements, particularly against major currencies and gold

– US Treasury yields, which influence global borrowing costs and asset valuations

Market participants say clarity, or the lack of it, will determine whether this episode remains a short-term political shock or evolves into a structural risk for global markets.

Recent Comments:

No comments yet.