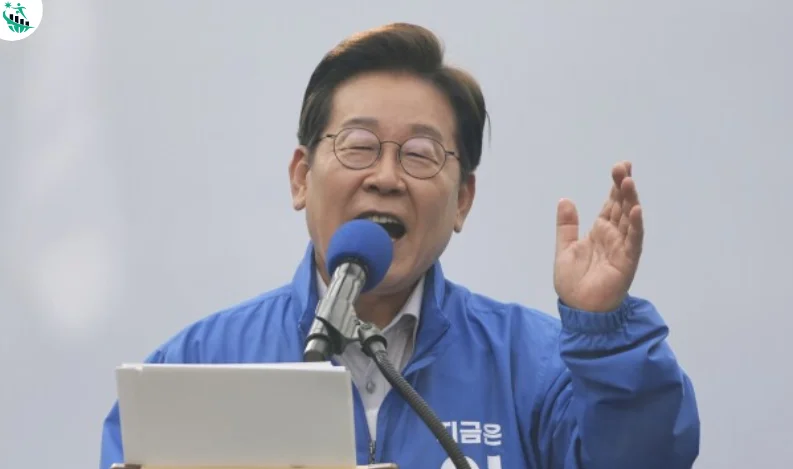

South Korean Stocks Lead Asia Rally After Opposition Leader Lee Jae-myung Wins Presidential Election

South Korean equities surged Wednesday, leading gains across the Asia-Pacific region, after opposition party leader Lee Jae-myung secured a decisive victory in the country’s snap presidential election.

The benchmark Kospi index rose 2.45% to 2,765.06, marking its highest level since August 2024. The small-cap Kosdaq index also gained 1.4%, continuing its strong performance this year with a 10.46% increase year-to-date.

The election outcome sparked optimism among investors, with markets anticipating pro-reform and shareholder-friendly policies under the new leadership.

“Lee’s election pledge has placed considerable weight on enhancing the value of the Korean stock market,” said John Cho, Korea equity portfolio manager at J.P. Morgan Asset Management. “Plans to amend commercial laws and better protect minority shareholder rights could lead to more value-accretive decisions by corporate boards.”

Major South Korean stocks rallied in response. SK Hynix surged 6.02%, SK Inc rose 5.63%, HD Hyundai gained 5.23%, and Woori Financial Group added 4.92%. Market heavyweight Samsung Electronics edged up 1.06%, while LG Energy Solutions rose 1.23%.

South Korean Won Strengthens; Inflation Slows

In currency markets, the South Korean won strengthened 0.43% against the U.S. dollar to 1,371.80, buoyed by both the election result and weakening sentiment around U.S. tariff policies. The move comes amid broader fluctuations in Asian currencies, with the Japanese yen rising and the Australian dollar slightly down.

On the macroeconomic front, South Korea’s inflation slowed to 1.9% year-on-year in May, the weakest pace in five months, easing from 2.1% in April. Month-on-month, consumer prices declined by 0.1%, according to data from Statistics Korea. The decline follows the Bank of Korea’s fourth interest rate cut in its current easing cycle, aimed at reviving domestic demand amid global trade pressures.

Broader Asian Markets Rise

Across Asia-Pacific, equity markets moved higher following gains on Wall Street, where Nvidia and other semiconductor firms led a rally:

-

Japan’s Nikkei 225 rose 0.88%, while the Topix index advanced 0.57%.

-

Mainland China’s CSI 300 edged up 0.43%, and Hong Kong’s Hang Seng Index gained 0.72%.

-

Australia’s S&P/ASX 200 broke above the key 8,500 mark, climbing 0.80% to a four-month high, supported by gains in energy, financials, and mining stocks.

-

Taiwan’s Taiex index soared 2.15% to 21,581.85, with TSMC and Foxconn up more than 3.5% each.

U.S. Market Snapshot

Overnight in the U.S., tech-led momentum pushed the Nasdaq Composite up 0.81% to close at 19,398.96, while the S&P 500 added 0.58% to 5,970.37. The Dow Jones Industrial Average rose 214.16 points, or 0.51%, ending at 42,519.64.

The rally followed a stronger-than-expected jobs report and continued enthusiasm for AI stocks, with Nvidia’s market capitalization surpassing Microsoft’s for the first time since January.

Recent Comments:

No comments yet.