Nvidia Issues Cautious Forecast, Raising Concerns Over AI Spending Slowdown

California — Nvidia Corp., the world’s most valuable publicly listed company, issued a cautious revenue outlook for the current quarter, stirring investor fears that the massive wave of artificial intelligence spending may be cooling.

The forecast, though in line with average Wall Street estimates, fell short of some expectations that Nvidia’s revenue would top $60 billion. The company excluded data center revenue from China, where US export restrictions and Beijing’s push for local alternatives have hampered growth. Shares dropped around 2% in extended trading following the announcement, despite a 35% rally earlier this year that had lifted Nvidia’s valuation above $4 trillion.

For the fiscal second quarter ending July 27, Nvidia reported sales of $46.7 billion, up 56% from a year earlier and slightly above estimates of $46.2 billion. It marked the smallest percentage gain in more than two years, even as profit rose to $1.05 a share, excluding certain items. Data center revenue reached $41.1 billion, narrowly missing forecasts, while gaming revenue came in at $4.29 billion, above estimates. Automotive sales slipped short at $586 million.

The company also authorized an additional $60 billion in stock buybacks, adding to $14.7 billion remaining under its previous plan.

Nvidia remains heavily exposed to the US-China technology rivalry. Earlier this year, Washington tightened restrictions on AI chip exports to Chinese customers before easing some rules in exchange for revenue-sharing. Beijing, meanwhile, has urged government entities to reduce reliance on US technology. Nvidia said it recorded no sales of its H20 AI chips to Chinese customers last quarter.

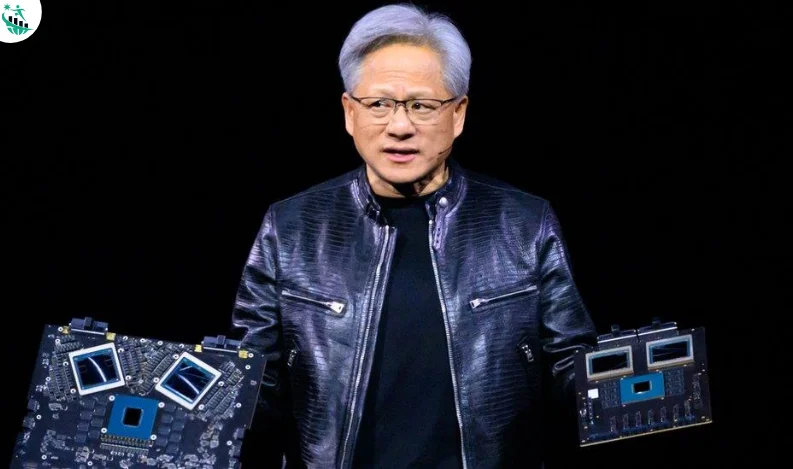

Under CEO Jensen Huang, Nvidia has transformed from a gaming-focused graphics chipmaker into the dominant supplier of AI accelerators. The company now generates quarterly revenue exceeding what it once made in an entire year. Still, analysts caution that Nvidia’s dependence on hyperscale customers such as Microsoft and Amazon leaves it vulnerable if AI infrastructure spending slows.

While demand for its AI chips remains strong, challenges persist with supply constraints and geopolitical uncertainty. Investors are watching closely to see whether Nvidia can maintain its growth trajectory, diversify its business, and expand beyond its reliance on a few key customers.

Recent Comments:

No comments yet.