Federal Reserve Officials Split on Interest Rate Path, Minutes Show

Federal Reserve officials were divided over the future direction of interest rates during their January meeting, according to minutes released Wednesday.

While policymakers agreed to keep the benchmark federal funds rate unchanged at their Jan. 27–28 meeting, discussions revealed uncertainty about whether rates should be lowered later this year, or potentially raised if inflation remains elevated.

The minutes from the Federal Open Market Committee (FOMC) showed that several participants believe further rate cuts could be appropriate if inflation continues to decline in line with expectations. However, others argued that policymakers should pause and assess incoming economic data before making additional adjustments.

“Some participants commented that it would likely be appropriate to hold the policy rate steady for some time,” the minutes noted, adding that additional easing may not be warranted until there is clear evidence that inflation is firmly moving back toward the Fed’s 2 per cent target.

Debate Over Inflation and Jobs

The discussion reflected broader concerns within the central bank about balancing inflation control with labor market stability. Some officials suggested that policy statements should better reflect the possibility of both rate cuts and rate hikes.

The minutes indicated that a few participants supported language acknowledging that upward adjustments to the federal funds rate could be necessary if inflation remains above target levels.

The Fed previously reduced its benchmark rate by three-quarters of a percentage point through consecutive cuts in September, October and December. Those moves brought the rate into a range of 3.5 per cent to 3.75 per cent.

Leadership and Voting Dynamics

The January meeting marked the first gathering for a new rotation of regional voting members. Although all 19 governors and regional presidents participate in discussions, only 12 hold voting rights.

The minutes did not identify individual policymakers but used terms such as “some,” “a few,” and “many” to describe positions. In two instances, the summary referred to a “vast majority” of participants.

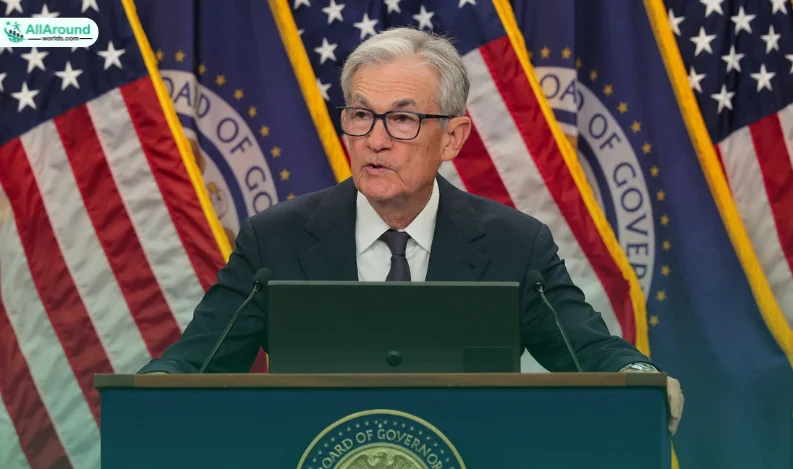

Federal Reserve Chair Jerome Powell’s current term ends in May. Market participants are also closely watching potential leadership changes, which could influence the direction of policy.

Inflation and Market Expectations

Officials generally expect inflation to ease over the course of the year, though the pace remains uncertain. The minutes noted that tariffs have contributed to price pressures but suggested their impact could diminish over time.

Most participants cautioned that progress toward the 2 per cent inflation target may be slower and more uneven than anticipated, with risks that inflation could persist above desired levels.

Recent economic data has presented mixed signals. While private-sector job growth has shown signs of slowing, the unemployment rate edged down to 4.3 per cent in January, and nonfarm payroll figures exceeded expectations.

Inflation indicators have also been mixed. The personal consumption expenditures (PCE) price index, the Fed’s preferred gauge, remains near 3 per cent. However, the core consumer price index, excluding food and energy, recently reached its lowest level in nearly five years.

According to CME Group’s FedWatch tool, futures traders currently anticipate the next rate cut could come in June, with a possible additional reduction later in the year.

The minutes underscore that while the Federal Reserve remains cautious, policymakers are weighing multiple economic factors before determining the next move in interest rates.

Recent Comments:

No comments yet.